Is there anything better than bringing in cash while you rest? Imagine waking up to find money flowing into your account effortlessly. This might sound like a dream, but Passive Income Ideas is more than just a far-fetched fantasy. According to Forbes contributor Brianna Wiest, it’s a limitless potential income stream, and she’s right: there’s always a chance to tap into it.

Before diving into my favorite strategies for earning money with minimal effort, I want to share why I am so passionate about this topic. First, passive income is often met with skepticism for reasons I don’t quite understand. Whenever I write articles or post YouTube videos about making money passively, people in the comments go wild, telling me I don’t know what passive income really means or that I’m out of touch.

Second, passive income has had a profound impact on my life. It has enabled my family to achieve numerous goals, allowing us to give generously and live on our own terms. The freedom it provides is invaluable.

When we talk about passive income, we’re referring to a stream of earnings that requires little to no effort to maintain once it’s set up. Think of it as money that flows in even when you’re not actively working, like royalties from a book, dividends from investments, or rental income from properties.

The idea is to create systems that generate steady cash flow, freeing you up to focus on other pursuits or simply enjoy more leisure time. It’s a fantastic way to achieve financial freedom, as it allows your income to grow independently of the hours you put in daily.

Additionally, passive income streams offer unparalleled time flexibility, letting you pursue passions, spend time with loved ones, or even embark on new business ventures. It’s about creating a sustainable lifestyle where your money works for you, rather than you constantly working for your money. This shift not only enhances your financial stability but also enriches your overall quality of life.

To illustrate my point, here are 9 passive income strategies I personally use to earn $1,000 or more every month. If you’re ready to set yourself up for success, pay close attention.

What is Passive Income?

Passive income is commonly described as a stream of income earned with minimal ongoing effort from the individual receiving it. This type of income is not directly tied to the time spent earning it. In contrast, dynamic income (such as a regular job or side gigs) involves an immediate exchange of time and skills for money. Examples of passive income include rental income from real estate, stock dividends, fixed income securities, book royalties, peer-to-peer lending, and stock photography royalties.

The fascinating aspect of passive income is that it can be generated even while you are sleeping, freeing up time for hobbies or allowing you to increase your earnings through other types of work while still maintaining steady streams of passive income. For instance, consider someone working a 9–5 office job with a fixed salary.

This same person also earns regular passive income from an eBook they wrote on gardening more than two years ago. The office job requires direct effort to generate a continuous supply of income, whereas the eBook is different. Regardless of what is happening in the office worker’s life, the book remains available for purchase in its digital format on Amazon, and the author does not need to perform any additional work (beyond the initial creation of the content) to maintain this stream of income.

Benefits

The benefits of passive income are numerous and can significantly enhance your financial well-being and overall quality of life. First and foremost, passive income offers financial security. Imagine having a steady stream of income that doesn’t require your daily grind – it’s like having a safety net that catches you if you ever decide to take a break or pursue a new passion. This type of income can provide peace of mind, knowing that your finances are taken care of, even if you’re not actively working.

Additionally, passive income brings a level of flexibility and freedom that active income can’t match. Here are some key benefits:

- Time Flexibility: Passive income allows you to manage your own time. Whether you want to spend more time with family, travel, or start new projects, passive income gives you the freedom to choose.

- Multiple Revenue Streams: By diversifying your income sources, you reduce the risk of financial instability. If one stream dries up, others can continue to support you.

- Scalability: Many passive income streams, like online businesses or investments, can grow over time with little additional effort, increasing your earnings without a proportional increase in work.

- Retirement Preparation: Building passive income streams can be an excellent strategy for preparing for retirement, ensuring that you have a steady income even when you decide to stop working actively.

In essence, passive income empowers you to live life on your own terms, providing both financial stability and the freedom to pursue what truly matters to you.

What rеаѕоn is Passive Inсоmе Important

There are numerous articles dedicated to exploring different approaches to generating passive income. However, many overlook the fundamental question: why is passive income (as opposed to active income) significant?

The answer lies in the relationship between time and money. Time is the most valuable asset. There are only 24 hours in a day, and time is the great equalizer because no one can have more of it. It cannot be replicated or re-spent. It exists once, then it’s gone. This is precisely why passive income is so important—time is more valuable than money.

Unlike money, which can be earned, saved, spent, invested, wasted, and lost, we cannot save minutes on a clock. We can’t earn interest on seconds or hours in a bank, or invest the time we didn’t use for something else. Considering that most people need to work professionally, consuming much of the time they have, this precious resource must be managed wisely.

Passive income is a key way the wealthy accumulate more wealth. It separates your ability to earn from the limited time you have each day. With passive income, you earn money while you sleep and while you’re awake. It’s automatic and keeps coming in.

“If you don’t figure out how to make money while you sleep, you will work until you die.” — Warren Buffett

However, creating a passive income stream is far from easy. It requires a tremendous amount of effort and investment of your time with little to no return initially. It involves a great deal of frustration and a steep learning curve. Nonetheless, it is one of the most rewarding investments of your time that you can undertake.

9 Passive Income Ideas To Earn $1,000 or more Every Month

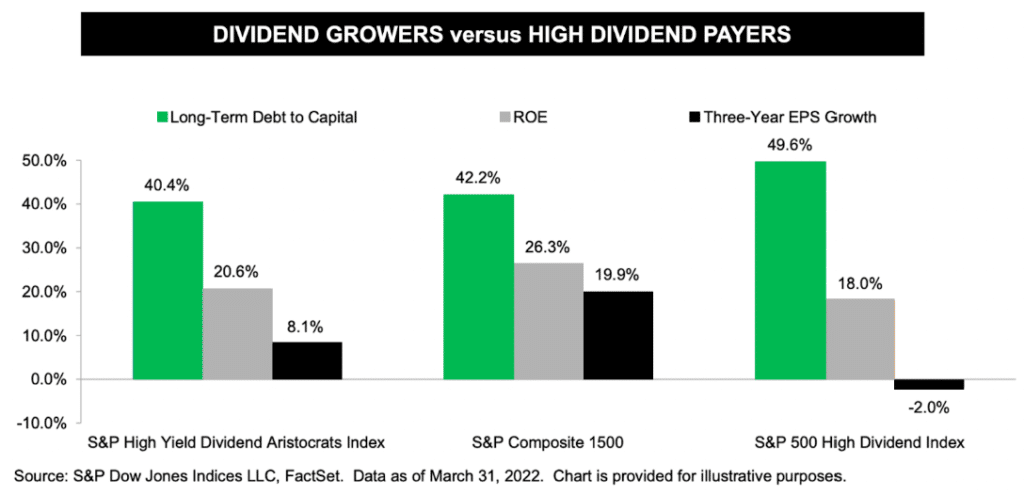

#1: Dividend-Paying Stocks and Other Investments

The main passive income idea on this list requires some initial investment but has enabled me to earn more than $1,000 every month consistently. Dividend-paying stocks, ETFs, and various other ventures like Fundrise and Lending Club are helping me generate steady income without any ongoing effort. Although the amounts I’ve invested in these accounts vary, they all collectively pay me over $1,000 each month.

Investing in profit-generating stocks has been a productive endeavor for me and many other investors. According to Forbes contributor Brett Owens, forward-looking dividend investors can potentially achieve annual returns of 15%, 20%, or even 25% if they select the right dividend-paying stocks and stay committed.

Of course, it takes time and consistent investing to build a portfolio that generates $1,000 every month. But you need to start somewhere, don’t you?

#2: Affiliate Marketing

Affiliate marketing, a well-established wealth-building method, offers a relatively new approach to passive income. This income strategy involves promoting other companies, or “partners,” through your website or platform. When someone uses your affiliate link to purchase a product or sign up for a service, you earn a commission.

Importantly, you don’t necessarily need to start a blog to succeed in affiliate marketing. Many people thrive in this field using YouTube, podcasts,telegram and other avenues. You can even build a successful affiliate business using social media!

10 Tips To Earn Passive Income On Amazon | Earn Upto $7,950 Per Month

#3: Display Ads

Another way I earn more than $1,000 every month passively is by utilizing display advertisements. This strategy involves leveraging your blog or website. The beauty of having an online property is that you can monetize it from various angles.

Display advertisements function like billboards you see on the highway, except they appear on your site. Advertisers pay to promote their products, and their ads are displayed on your site. Most display ads are managed by ad networks that act as intermediaries between you and the advertisers willing to pay you.

The best part about display ads is that they are completely passive. You can earn a significant amount of money based on your traffic — even while you sleep!

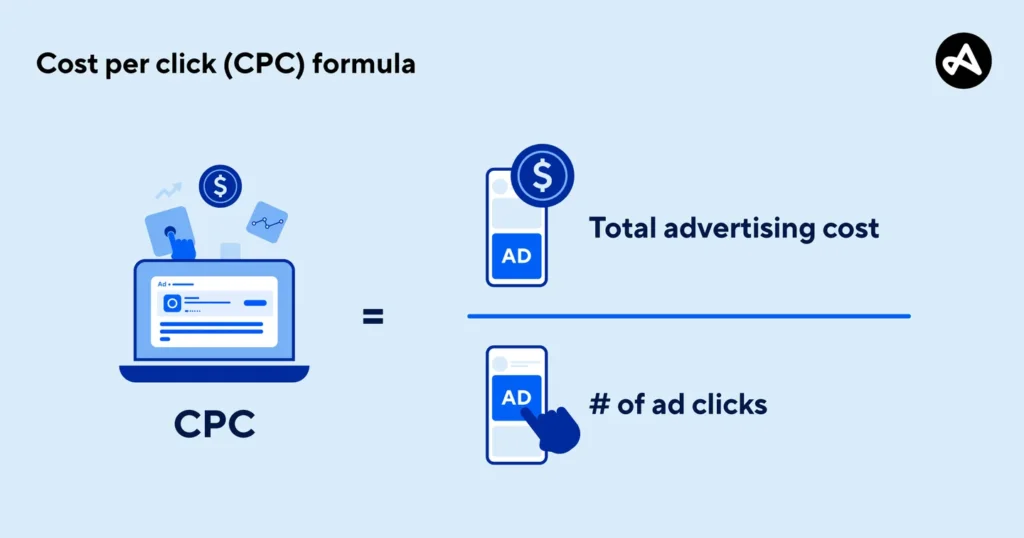

#4: CPC Ads (Cost Per Click)

With affiliate marketing, you earn money when someone clicks on your link and either pursues something or makes a purchase. In contrast, display advertisements pay based on the amount of traffic and the number of views their promotions receive.

CPC promotions, or “cost per click” advertisements, work differently. You get paid whenever someone clicks on an advertisement, regardless of what they do afterward. There’s no need to rely on them making a purchase or taking any further action. Every single click puts money in your account.

Does this mean I can just go to my own site and click on the ads all day? While I could technically do that, the advertising network would quickly catch on and ban me! Therefore, clicking on your own advertisements should not be part of your strategy. Instead, focus on growing your traffic so that more and more people consistently see your ads.

#5: Sell Leads

After successfully launching Good Financial Cents, I ventured into creating a specialized protection site called Life Insurance by Jeff. Remarkably, within just nine months of launching this site, I managed to generate $100,000 in income. Although building the site initially required significant effort and wasn’t passive at all, we eventually made several changes to make it considerably more passive over time.

Ultimately, I decided that selling the leads my site produced was a much better arrangement than earning commissions on actual sales. While selling leads is less lucrative than earning life insurance commissions, I realized that selling life insurance involved a tremendous amount of work. To scale things up, I would have needed to hire individuals, manage a team, and invest a significant amount of time and effort. I wasn’t particularly interested in doing any of that, which is why I chose to start selling leads. By doing so, I now earn passive income with minimal effort on my part.

#6: Course Sales

Currently, the main course I sell is an internet advertising course for financial advisors. Even though I hardly promote it, I still receive a substantial number of sales. The course isn’t cheap either — it costs $2,500!

While it took a tremendous amount of work to create this course three years ago, everything I’ve done since then has been to sit back and collect cash from the occasional sale. I consistently make over $1,000 every month from the course now, on top of the thousands of dollars I made when I was actively promoting it regularly.

That said, earning money from course sales isn’t as simple as flipping a switch! You need to create the course first, which can take weeks or months of your time. Once you’ve completed the work required to make your product, however, the income can become passive.

Holly Johnson, an expert freelance writer who earns over $200,000 every year creating online content, is another successful entrepreneur doing well with course sales. Johnson launched her “Earn More Writing” freelance writing course in 2017 and has sold more than 700 courses for $199 each since then. In January 2019, she also launched a “Pro” version of her course that retails for $349. She sold 40 on the first day.

“Selling 700 courses doesn’t seem like a lot,” says Johnson. “However, when the cost of a course is a hundred dollars or more, you don’t need to sell thousands to earn significant income.”

That’s a valid point, and it’s one to consider if you have skills to teach that people will pay $100 or more to learn. If you can attract enough buyers or if your price is sufficiently high, courses can generate a substantial income over time.

#7: Create a Digital Product

While courses are advanced items you can sell repeatedly, there are various types of digital products you can venture into. These include digital books, online guidance guides, and essentially any other items you can market and sell online.

My most recent digital product is an online test designed to help individuals earn $1,000 online. I initially offered this test for free, but I provided an option to pay $7 for an upgraded package that includes PDFs and instructional worksheets.

This upgrade is just $7, but even small amounts can add up quickly when you’re selling a few hundred every month.

The main takeaway: Think of an online product you can create that solves a problem or offers assistance. Once you create it, you can sell it repeatedly and earn passive income while you sleep.

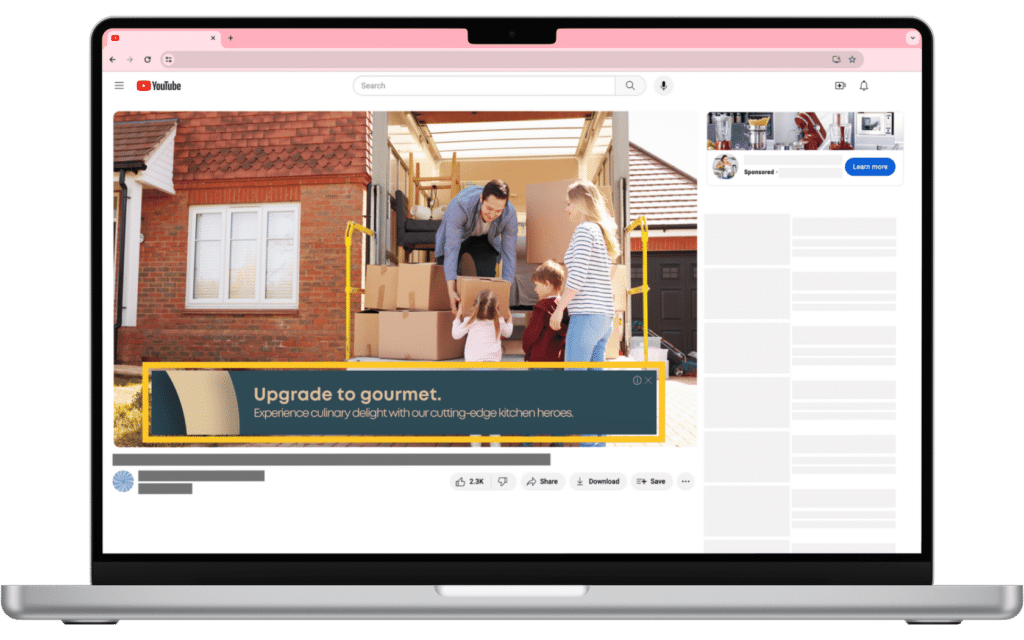

#8: YouTube Ads

While YouTube promotions aren’t as “passive” as some other income-generating methods on this list, they still fit in with the overall theme. I’m already creating YouTube videos, so why not post promotions to earn some extra income? The passive aspect comes in because I create the video once and earn income repeatedly as more people watch it.

For instance, I took a significant amount of downtime with my children over the holidays since they were out of school. I don’t think I recorded any new videos during that time—maybe just one—but the passive income kept rolling in because the same number of people continued to watch my show on YouTube.

It’s astonishing how much content YouTube viewers consume. Some people thrive by making videos about incredibly niche topics. Take “Ooze Queen” Karina Garcia, for example, who boasts more than 10 million social media followers who tune in to watch her play with slime. According to Forbes, she’s only 24 years old, yet she’s making a fortune!

If you love being on camera and want to earn some passive income while you rest, YouTube promotions are the way to go.

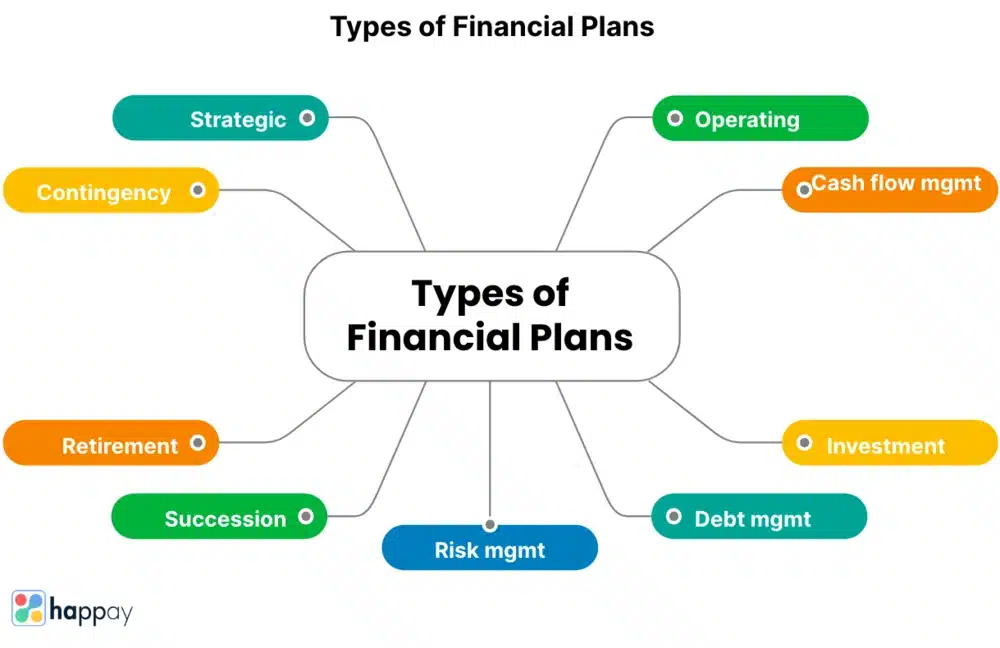

#9: My Financial Planning Business

Although I reside with my family near Nashville, Tennessee, I previously operated a financial planning practice in Illinois. Despite not actively engaging in that business for quite some time, it continued to generate a significant amount of profit. How much? Well, my financial planning process has consistently yielded over $400,000 in revenue annually over the past few years—with minimal effort on my part.

Conclusion

Passive income is a game-changer when it comes to achieving financial freedom. It offers several key benefits, such as financial security, time flexibility, and the potential for scalable income. Imagine having a steady stream of income without the daily grind. It’s like having a safety net that catches you whenever you need to take a break or pursue new passions. This type of income gives you peace of mind, knowing that your finances are taken care of, even if you’re not actively working. Moreover, passive income provides unparalleled time flexibility, allowing you to spend more time with family, travel, or start new projects.

Starting small and scaling up is the best approach when venturing into passive income. You don’t need to dive into everything at once. Begin with one or two passive income streams, like dividend-paying stocks or a rental property, and gradually build from there. Here are a few steps to keep in mind:

- Start Small: Choose manageable and low-cost options initially.

- Diversify: Spread your investments across different passive income streams.

- Automate: Use tools and systems to manage your income streams efficiently.

- Reinvest: Channel the earnings back into your passive income ventures to grow them.

Achieving financial freedom through passive income is entirely possible with the right strategy and mindset. It’s about creating a sustainable lifestyle where your money works for you, allowing you to focus on what truly matters. By taking small steps today, you can build a robust financial future that offers both stability and freedom. So, start exploring your options, invest in your future, and watch your passive income grow.

Frequently Asked Questions (FAQs) about Passive Income

1. What is passive income?

Passive income refers to earnings derived from activities in which you are not actively involved on a regular basis. Examples include rental income, dividends from investments, royalties from books, and earnings from online businesses.

2. How does passive income differ from active income?

Active income requires continuous effort and time to earn, such as a regular job or freelance work. Passive income, on the other hand, continues to generate revenue with minimal ongoing effort after the initial setup.

3. What are some common sources of passive income?

- Real Estate: Rental properties and REITs.

- Investments: Dividend stocks, bonds, and mutual funds.

- Digital Products: eBooks, online courses, and print-on-demand merchandise.

- Online Businesses: Affiliate marketing, YouTube ad revenue, and blogs with display ads.

4. How much initial investment is needed to start earning passive income?

The initial investment varies depending on the passive income stream. For example, investing in stocks or real estate typically requires more capital, whereas starting a blog or YouTube channel may require minimal financial investment but significant time investment initially.

5. Is passive income truly “hands-off”?

While passive income is less time-consuming than active income, it usually requires some initial effort to set up and occasional maintenance. For example, rental properties need tenant management, and online content needs periodic updates.

6. Can anyone earn passive income?

Yes, anyone can earn passive income with the right knowledge and strategy. It’s essential to choose the right passive income stream that aligns with your interests, skills, and available resources.

7. How long does it take to start earning passive income?

The time frame varies widely. Some income streams, like high-yield savings accounts or dividend stocks, can start generating income relatively quickly. Others, like building a successful blog or YouTube channel, can take months or even years to become profitable.

8. What are the risks associated with passive income?

- Market Risks: Investments in stocks or real estate can fluctuate with market conditions.

- Initial Costs: Some passive income streams require significant upfront investment.

- Time Commitment: Setting up and maintaining passive income streams can be time-consuming initially.

9. How can I start generating passive income?

- Research: Learn about different passive income streams.

- Plan: Choose one or two methods that fit your skills and resources.

- Invest: Allocate time and/or money to set up your passive income stream.

- Maintain: Periodically check and manage your investments or projects to ensure they continue generating income.

10. Is passive income taxable?

Yes, passive income is generally subject to taxation. The specific tax treatment can vary depending on the income type and jurisdiction. It’s advisable to consult with a tax professional to understand your tax obligations.